Fillable Form 941 for 2023

Simple, Quick, and Easy. It takes less than 5 minutes.

Lowest Price $5.95

E-File Form 941 Easily and Quickly

The longer you wait in a queue, the higher the chance of penalties. Cut down the cost of envelopes and stamps by file Form 941 electronically and also avoid the late filing penalties.

E-file Form 941 in just a few minutes

You are required to sign your 941 Form either by using an online signature pin or Form 8453-EMP. If you don't possess an online signature PIN you can still use Form 8453-EMP to Sign and authorize your Form 941 to e-file with the IRS.

E-File Form 941 at just $5.95/form

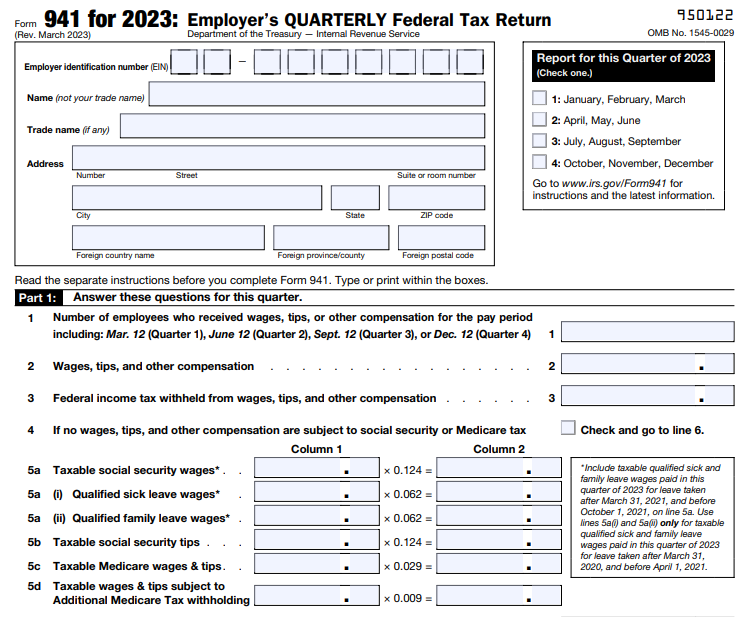

Form 941 Overview

Form 941, Employer’s Quarterly Federal Tax Return is used to track income taxes, social security and medicare taxes withheld by employers from employee paychecks. This form is also used to report the employer’s portion of FICA tax (Social Security and Medicare Tax).

WHAT IS FORM 941 WORKSHEET AND WHY SHOULD YOU COMPLETE IT?

Tax Form 941 Worksheet is used to calculate the qualified sick and family leave wages and employee retention tax credit.

IRS revised the Form 941 Worksheet 1 for the 2nd quarter of 2021. According to this, the Step 3 in the Worksheet 1 is made into a separate Tax Form 941 Worksheet 2 for 2nd quarter 2021 for calculating the employee retention credit on wages paid after March 31, 2021 and before July 1, 2021.

Form 941 Worksheet 4 is for calculating employee retention credit for the third and fourth quarter. Other than these, Worksheet 3 and Worksheet 5 are added for the remaining quarters of 2021.

Visit https://www.taxbandits.com/form-941/worksheet-4/ to learn more.

Why should you choose FillableForm941.com?

- Quick and easy to use solution for employers to create 941 fillable Form.

- You can also download Schedule B (Form 941) and Form 8974 for free.

- Create unlimited forms if you are filing for more than one business.

- Use our effective dashboard to organize all your forms under a single account.

- E-file 941 is available at $5.95/return where your 941 returns are directly transmitted to IRS.

- 24/7 email support to assist you with the queries and concerns you have about our product.

Steps to Create Fillable Form 941 for 2023 Tax Year

Create your free account, Follow the simple steps to complete Fillable Form 941:

-

Fill in Form 941 details

-

Fill Schedule B if you are a semi-weekly depositor

-

Fill Form 8974 if you claim the payroll tax credit

-

Review & Transmit directly to IRS

efile your Form 941 with the IRS for just 5.95/Form.

When is the Deadline to File IRS Form 941 for 2023?

First Quarter

January - March

May 1st, 2023

Second Quarter

April - June

July 31st, 2023

Third Quarter

July - September

October 31st, 2023

Fourth Quarter

October - December

January 31st, 2024

If the 941 due date falls on a weekend or legal holiday, then you have to file by the next

business day.

Where Do I Mail Form 941 For 2023?

The IRS requires every 941 filer to send the copy to them in case of paper filing. Form 941 mailing address depends on the state your business is in and whether you include a payment with 2023 Form 941.

Visit https://www.taxbandits.com/form-941/941-mailing-address/ to know the mailing address

for each state.

Form 941 Late Filing Penalty

If you fail to file your Form 941 by the deadline, you will be subjected to 941 late filing penalty:

- Your business will incur a penalty of 5% of the total tax amount due.

- You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.

- In addition to failing to file, if you did not pay your owed tax bill you will initially be charged .5% of the unpaid tax amount, and this fee will increase each month the payment remains unpaid.

- The penalty will increase to 1% ten days following the IRS notice of intent to levy.

Visit https://www.taxbandits.com/payroll-forms/form-941-penalty/ to know more about the late filing

penalties for 941.

TaxBandits IRS E-file API Integration allows you to extend your software.

The TaxBandits APIis built with the RESTful architecture. To post any data requests, our API uses HTTP requests. All queries, response bodies, and error codes are encoded in JSON by this API.

You will be given access to a private sandbox testing environment where you will be able to test the application using real-world data. The API checks each request received and offers additional API access using authentication keys. You will receive 500 free credits for each tax form on your TaxBandits Sandbox account to begin testing your API account.

In addition TaxBandits also provides API solutions for other forms such as Forms 1099, W-2, 941 API and W-9 forms . Try TaxBandits API solution today and see how it simplifies your tax reporting. Request a demo

Complete and File Form 941 online for 2023

Simple, Quick, and Easy. It takes less than

5 minutes.

Helpful Resources for Form 941

File Form 941 for the 2023 Tax Year

E-File Now and get the filing status instantly.

Lowest Price $5.95/form

File Form 941 for the 2023 Tax Year

E-file the updated Form 941 in minutes and get

the filing status instantly.

Lowest Price $5.95

- Instant IRS Approval

- Quick & Secure

- In-built error check